In today's rapidly evolving financial landscape, the desire to diversify investment portfolios has become more significant than ever. One name that stands out in the investment world is Tesla, a company that has not only revolutionized the automotive industry but also created a buzz in the financial markets. The Tesla investment platform presents a unique opportunity for investors to tap into the dynamic growth of one of the most innovative companies of our time. Whether you're a seasoned investor or just starting, the Tesla investment platform offers a wide array of options to suit different investment strategies and goals.

As we delve deeper into the world of Tesla investments, it's essential to understand the myriad of opportunities that this platform provides. Tesla, known for its cutting-edge technology and ambitious projects, has consistently shown a strong financial performance, making it an attractive choice for investors. From electric vehicles to renewable energy solutions, Tesla's diverse portfolio aligns with the growing trend of sustainable investing. The Tesla investment platform not only offers access to Tesla's stock but also provides insights into their financial strategies, helping investors make informed decisions.

The Tesla investment platform is more than just a gateway to investing in Tesla Inc.; it's a comprehensive tool that empowers investors with resources, market analysis, and expert insights. With a user-friendly interface and real-time data, the platform caters to both novice and experienced investors. As we explore the various facets of the Tesla investment platform, we will uncover the benefits it brings to those looking to capitalize on the growth of a company that continues to push the boundaries of innovation.

Table of Contents

- Biography of Elon Musk

- What Makes Tesla Investment Platform Unique?

- How Does Tesla Investment Platform Work?

- Benefits of Investing in Tesla

- Is Tesla Investment Platform Right for Me?

- Financial Performance of Tesla

- How to Get Started with Tesla Investment Platform?

- Tesla's Impact on the Environment

- Understanding Tesla's Business Model

- What Are the Risks of Investing in Tesla?

- Expert Tips for Investing in Tesla

- Tesla Investment Platform vs. Other Investment Options

- Frequently Asked Questions

- Conclusion

Biography of Elon Musk

Elon Musk, the visionary behind Tesla, has become a household name synonymous with innovation and entrepreneurship. Born in Pretoria, South Africa, on June 28, 1971, Musk has always shown a keen interest in technology and engineering. After attending the University of Pretoria, he moved to Canada and later to the United States, where he pursued degrees in physics and economics at the University of Pennsylvania. Musk's journey from a tech-savvy youngster to a billionaire entrepreneur is a testament to his relentless drive and ambition.

| Full Name | Elon Reeve Musk |

|---|---|

| Birth Date | June 28, 1971 |

| Birth Place | Pretoria, South Africa |

| Education | University of Pretoria, University of Pennsylvania |

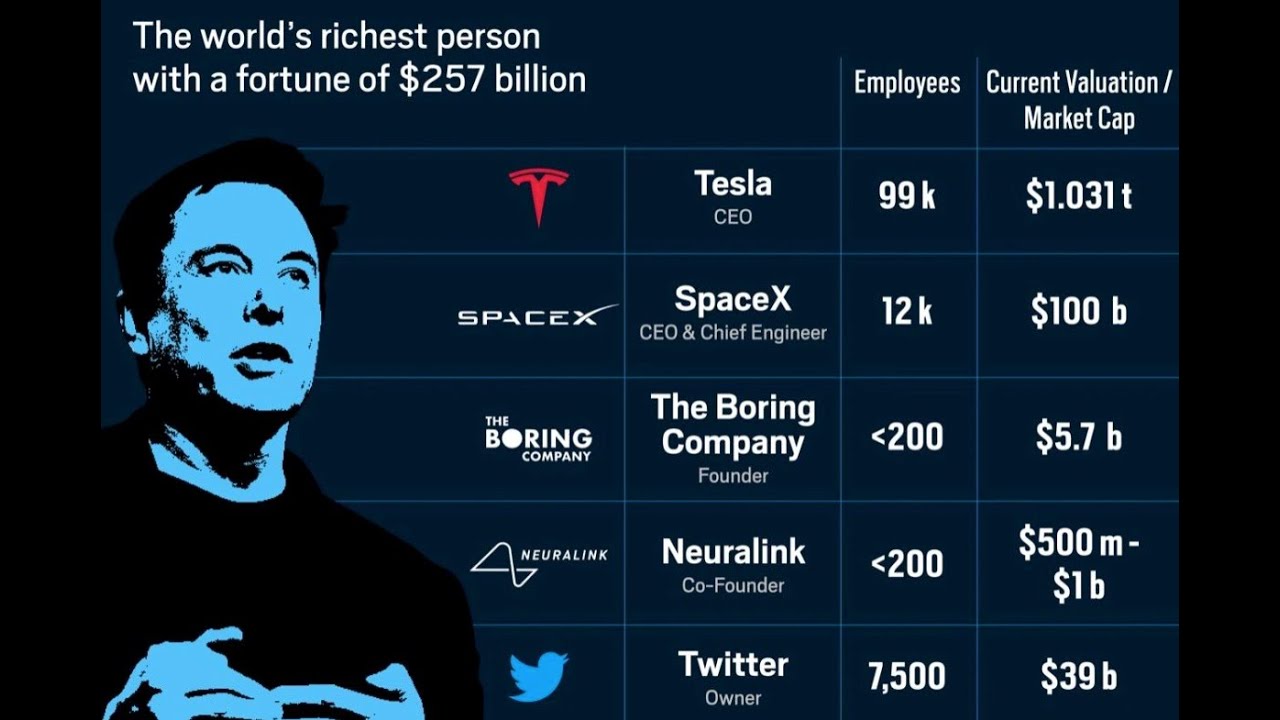

| Known For | Tesla, SpaceX, Neuralink, The Boring Company |

Elon Musk's entrepreneurial journey began with the founding of Zip2, an online city guide software, which was later sold to Compaq for nearly $300 million. He then co-founded X.com, an online payment company that eventually became PayPal and was sold to eBay for $1.5 billion in stock. Musk's ventures didn't stop there; he went on to become the CEO of Tesla and founded SpaceX, Neuralink, and The Boring Company, all of which aim to push the boundaries of technology and transportation.

Under Musk's leadership, Tesla has grown exponentially, becoming a leader in the electric vehicle industry. His vision for a sustainable future and commitment to innovation have made Tesla a key player in the transition to renewable energy. As we explore the Tesla investment platform, it's crucial to recognize the impact of Musk's leadership and vision on the company's success.

What Makes Tesla Investment Platform Unique?

The Tesla investment platform stands out for several reasons, making it a preferred choice for investors looking to diversify their portfolios. Firstly, the platform offers unparalleled access to Tesla's stock, allowing investors to buy, sell, and manage their investments with ease. This streamlined process removes many of the traditional barriers to entry, making it accessible to both seasoned investors and newcomers to the market.

Additionally, the Tesla investment platform is designed with user experience in mind. Its intuitive interface and real-time data provide investors with the tools they need to make informed decisions. With features such as customizable dashboards, market analysis, and expert insights, the platform caters to various investment strategies, whether you're a short-term trader or a long-term investor.

Furthermore, Tesla's commitment to innovation is reflected in its investment platform. By leveraging cutting-edge technology, the platform offers advanced security measures, ensuring that investors' data and funds are protected. This focus on security and transparency helps build trust among investors, making Tesla a reliable choice for those looking to grow their wealth.

How Does Tesla Investment Platform Work?

The Tesla investment platform operates as a comprehensive tool for managing investments in Tesla stocks. At its core, the platform simplifies the process of buying and selling Tesla shares, enabling investors to execute trades with just a few clicks. To get started, investors need to create an account on the platform, which involves providing some personal information and linking a bank account for transactions.

Once the account is set up, investors can access a range of features designed to enhance their trading experience. The platform provides real-time market data, allowing users to monitor Tesla's stock performance and make timely decisions. It also offers analytical tools and resources, such as charts, graphs, and expert insights, to help investors understand market trends and develop effective investment strategies.

One of the standout features of the Tesla investment platform is its customizable dashboard. Investors can tailor their experience by selecting the information and tools most relevant to their needs. Whether you want to track your portfolio's performance or stay updated on the latest Tesla news, the platform provides a personalized experience to keep you informed and engaged.

Benefits of Investing in Tesla

Investing in Tesla offers numerous benefits, making it an attractive option for those looking to diversify their portfolios. One of the primary advantages is Tesla's strong financial performance. Over the years, the company has consistently delivered impressive earnings, driven by its innovative products and expanding market presence. This financial stability and growth make Tesla a reliable choice for investors seeking long-term gains.

Another benefit of investing in Tesla is the company's commitment to sustainability. As a leader in the electric vehicle industry, Tesla is at the forefront of the transition to renewable energy. By investing in Tesla, investors can align their portfolios with their values and support the shift towards a more sustainable future.

Moreover, Tesla's diverse portfolio offers investors exposure to various sectors beyond automotive. With ventures in energy storage, solar power, and autonomous driving, Tesla is well-positioned to capitalize on emerging trends and technologies. This diversification provides investors with the opportunity to benefit from multiple revenue streams and reduce risk.

Is Tesla Investment Platform Right for Me?

Determining whether the Tesla investment platform is right for you involves considering several factors. Firstly, it's essential to evaluate your investment goals and risk tolerance. If you're looking for a long-term investment with the potential for significant growth, Tesla's strong financial performance and commitment to innovation make it an attractive option.

Additionally, consider your investment strategy and how it aligns with Tesla's business model. Tesla's focus on sustainability and renewable energy may appeal to investors seeking to support environmentally friendly initiatives. However, it's also important to be aware of the risks associated with investing in a high-growth company, such as market volatility and regulatory challenges.

Ultimately, the Tesla investment platform is suitable for a wide range of investors, from those just starting to build their portfolios to seasoned traders looking for new opportunities. By offering a user-friendly interface and comprehensive resources, the platform empowers investors to make informed decisions and achieve their financial goals.

Financial Performance of Tesla

Tesla's financial performance has been nothing short of impressive, making it a standout player in the automotive and renewable energy sectors. Over the past decade, Tesla has consistently delivered strong earnings, driven by its innovative products and expanding market presence. The company's revenue has seen significant growth, supported by increased vehicle deliveries and the successful launch of new models, such as the Model 3 and Model Y.

Moreover, Tesla's commitment to cost management and operational efficiency has contributed to its profitability. By optimizing production processes and reducing manufacturing costs, Tesla has been able to improve its gross margins and deliver value to shareholders. This focus on efficiency, coupled with its strong brand recognition, has positioned Tesla as a leader in the electric vehicle industry.

Another key aspect of Tesla's financial performance is its ability to generate cash flow. The company's positive cash flow from operations provides it with the resources needed to invest in research and development, expand production capacity, and explore new markets. This financial flexibility enables Tesla to pursue ambitious projects and maintain its competitive edge in the rapidly evolving automotive landscape.

How to Get Started with Tesla Investment Platform?

Getting started with the Tesla investment platform is a straightforward process that involves a few key steps. First, you'll need to create an account on the platform by providing some basic personal information and linking a bank account for transactions. Once your account is set up, you can begin exploring the platform's features and resources.

To start investing, you'll need to deposit funds into your account, which can be done through a variety of payment methods. Once your account is funded, you can begin buying and selling Tesla shares with just a few clicks. The platform's user-friendly interface makes it easy to execute trades and manage your portfolio, even if you're new to investing.

In addition to its trading capabilities, the Tesla investment platform offers a wealth of resources to help you make informed decisions. From real-time market data to expert insights and analytical tools, the platform provides everything you need to develop effective investment strategies and achieve your financial goals.

Tesla's Impact on the Environment

Tesla's impact on the environment extends beyond its innovative electric vehicles. As a pioneer in the transition to renewable energy, Tesla is committed to reducing the carbon footprint of the transportation and energy sectors. By producing electric vehicles that emit zero emissions, Tesla is helping to combat climate change and improve air quality worldwide.

In addition to its automotive division, Tesla's energy products, such as solar panels and energy storage solutions, contribute to a more sustainable future. These products enable individuals and businesses to generate clean energy and reduce their reliance on fossil fuels. By promoting the adoption of renewable energy, Tesla is playing a crucial role in the fight against climate change and the pursuit of a greener world.

Understanding Tesla's Business Model

Tesla's business model is built on innovation and sustainability, making it a unique player in the automotive and energy sectors. At its core, Tesla aims to accelerate the world's transition to sustainable energy by producing electric vehicles and renewable energy products. This dual focus allows Tesla to capitalize on emerging trends and create multiple revenue streams.

One of the key components of Tesla's business model is its direct-to-consumer sales strategy. By bypassing traditional dealership networks, Tesla is able to offer a personalized buying experience and maintain control over its brand image. This approach not only enhances customer satisfaction but also improves Tesla's profit margins.

Furthermore, Tesla's commitment to research and development is a driving force behind its success. By investing in cutting-edge technology and exploring new markets, Tesla is able to stay ahead of the competition and deliver innovative products that meet the needs of consumers. This focus on innovation and sustainability has positioned Tesla as a leader in the electric vehicle industry and a key player in the transition to renewable energy.

What Are the Risks of Investing in Tesla?

While investing in Tesla offers numerous benefits, it's essential to be aware of the potential risks associated with this high-growth company. One of the primary risks is market volatility. As a leader in the electric vehicle industry, Tesla's stock price can be influenced by various factors, such as changes in government regulations, competition, and global economic conditions. This volatility can result in significant fluctuations in stock prices, making it important for investors to be prepared for potential ups and downs.

Another risk to consider is the regulatory environment. As a company operating in the automotive and energy sectors, Tesla is subject to various regulations and standards that can impact its operations and financial performance. Changes in government policies, such as emissions standards or tax incentives, can affect Tesla's business model and profitability.

Additionally, Tesla's ambitious growth plans come with inherent risks. The company's expansion into new markets and development of new technologies require significant capital investment and resource allocation. While these ventures have the potential for substantial returns, they also carry the risk of delays, cost overruns, and technical challenges.

Expert Tips for Investing in Tesla

Investing in Tesla can be a rewarding experience, but it's essential to approach it with a well-thought-out strategy. Here are some expert tips to help you make the most of your Tesla investment:

- Diversify Your Portfolio: While Tesla offers exciting growth potential, it's important not to put all your eggs in one basket. Diversifying your portfolio across different asset classes and industries can help mitigate risk and enhance returns.

- Stay Informed: Keeping up with the latest news and developments in the automotive and energy sectors can provide valuable insights into Tesla's performance and future prospects. Subscribe to reputable financial news sources and follow industry trends to stay informed.

- Set Realistic Goals: Establishing clear investment goals and timeframes can help you stay focused and make informed decisions. Whether you're aiming for long-term growth or short-term gains, having a plan in place can guide your investment strategy.

- Be Prepared for Volatility: Tesla's stock price can be volatile, so it's important to be prepared for potential fluctuations. Having a long-term perspective and maintaining a diversified portfolio can help you weather market ups and downs.

Tesla Investment Platform vs. Other Investment Options

When considering the Tesla investment platform, it's essential to compare it to other investment options available in the market. One of the key advantages of the Tesla investment platform is its focus on a single, high-performing company with a strong track record of innovation and growth. This concentrated approach allows investors to tap into Tesla's potential while benefiting from the company's established market presence.

In contrast, other investment options, such as mutual funds or exchange-traded funds (ETFs), offer diversification across multiple assets and industries. While this diversification can help reduce risk, it may also dilute potential returns compared to a concentrated investment in a high-growth company like Tesla.

Ultimately, the Tesla investment platform is best suited for investors who believe in Tesla's long-term growth prospects and are comfortable with the associated risks. By offering a user-friendly interface and comprehensive resources, the platform empowers investors to make informed decisions and achieve their financial goals.

Frequently Asked Questions

1. How do I open an account on the Tesla investment platform?

To open an account on the Tesla investment platform, visit the platform's website and follow the registration process. You'll need to provide some personal information and link a bank account to facilitate transactions.

2. Can I invest in Tesla if I'm new to investing?

Yes, the Tesla investment platform is designed to be user-friendly and accessible to both novice and experienced investors. The platform offers resources and tools to help you make informed decisions and develop effective investment strategies.

3. What are the fees associated with the Tesla investment platform?

The fees associated with the Tesla investment platform may vary depending on the services and features you use. It's important to review the platform's fee structure before investing to understand any costs that may apply.

4. Is my investment safe on the Tesla investment platform?

The Tesla investment platform employs advanced security measures to protect your data and funds. However, like any investment, there are risks involved, and it's important to be aware of them before investing.

5. How often can I trade Tesla shares on the platform?

You can trade Tesla shares on the platform as frequently as you like, subject to any applicable trading restrictions or fees. The platform's real-time data and user-friendly interface make it easy to execute trades and manage your portfolio.

6. Can I invest in other companies through the Tesla investment platform?

The Tesla investment platform is primarily focused on Tesla stocks. If you're interested in investing in other companies, you may need to explore additional investment platforms or brokerage accounts.

Conclusion

The Tesla investment platform offers a unique opportunity for investors to tap into the growth of one of the most innovative companies in the world. With its user-friendly interface, comprehensive resources, and focus on Tesla's strong financial performance, the platform empowers investors to make informed decisions and achieve their financial goals. By understanding the benefits and risks associated with investing in Tesla, you can develop a strategy that aligns with your investment objectives and risk tolerance. Whether you're a seasoned investor or just starting, the Tesla investment platform provides the tools you need to succeed in the dynamic world of investing.